Don't leave your old number behind

Friday, October 7, 2016

A SIM card is a small item that seemingly has no value. After all, it can be replaced free of charge at any time. That's why many people are quick to throw away an old SIM card without thinking about the possible consequences.

If the owner of a bank card changes their SIM card but neglects to disable their mobile banking service, the next owner of the phone number will automatically become the service subscriber at absolutely no cost to them. Meanwhile, the service fee will be debited from the bank card that belongs to the previous SIM-card owner. Thus, all transaction information will be sent to the old phone number, which now belongs to the SIM card’s newest owner. As a result, scammers can use the mobile banking service to transfer money from the bank card to their account.

In Russia, a man purchased a SIM card from a certain mobile carrier. After a while, he began receiving SMS notifications about funds being credited to the bank account belonging to the person who previously owned his phone number. The man took advantage of the situation and used SMS commands to transmit money to his own account. The previous owner, a woman, who was under pressure to raise money for medical assistance for her mother, did not use her card for an extended period of time. So the man made off with 900 USD from her account.

Banks have no way of knowing who is currently using a SIM card and the cell phone into which it’s inserted (and this situation won't change until ID chips are implanted into our bodies and we become part of the IoT). In fact, a SIM card acts as a user ID and should be regarded as personal information. However, users, when they lose or replace their SIM cards or phones, don’t realise that they are essentially doing the same thing as changing their ID, only in a digital world. And while everyone knows that a lost ID can be used to get a loan in a bank, few people know that a lost SIM card can be put to use by someone else.

Welcome to the brave new digital world!

The Anti-virus Times recommends

- If for some reason you are planning to stop using your SIM card, first disable all the services associated with the phone number (including automatic payment services).

- If you've lost your phone (perhaps, you used it for remote banking), do the following: contact the bank immediately to block the remote banking service and get in touch with your mobile carrier to block the SIM card. In some cases such services can be disabled by sending a special code to a specific mobile operator number—find out beforehand how this is done.

- If you change the phone number you use for remote banking, first contact the bank to associate the service with the new number and only after that discard the old SIM card.

- Be careful: mobile operators can transfer your phone number to another subscriber if you stop using it for a long period of time.

- To prevent the unauthorized use of mobile banking services, don’t leave your phone unattended and unlocked.

- Don’t enable remote banking on devices that don’t belong to you even if someone has asked you to. Remember that scammers can pose as bank employees.

- If your SIM card suddenly becomes non-operational, contact your mobile carrier. The card may have been blocked as a result of fraudulent activities conducted in your name or from your device as a result of it getting infected. Whatever the reason for the blocking, its cause must be clarified. This will determine the next steps you need to take.

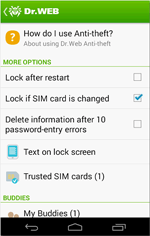

- Because the loss of your phone means that you can’t disable services or access the Internet, and you won't be able to look up your bank's phone number, install and activate the Dr.Web Anti-theft service—that way you can lock your device remotely using a friend's cell phone.

You can control the anti-theft with SMS commands.

When you first start Dr.Web Anti-theft, a configuration wizard will help you set up the component.

You will need to specify an access password and configure your buddies list.

Make sure you’ll remember the password because it will be used to control all the Anti-theft features and unlock your device (if it gets locked). If you forget your anti-theft password, use the special password-reset service and unlock your device.

Dr.Web Anti-theft allows you to create a buddies list (of up to five phone numbers). The numbers on the list can be used to send SMS commands remotely if you forget your anti-theft password.

If registration is successful, the configuration wizard will finish its work and you’ll see the Dr.Web Anti-theft settings window.

![Shared 15 times [Twitter]](http://st.drweb.com/static/new-www/social/no_radius/twitter.png)

Tell us what you think

To leave a comment, you need to log in under your Doctor Web site account. If you don't have an account yet, you can create one.

Comments

vasvet

08:28:48 2018-07-01